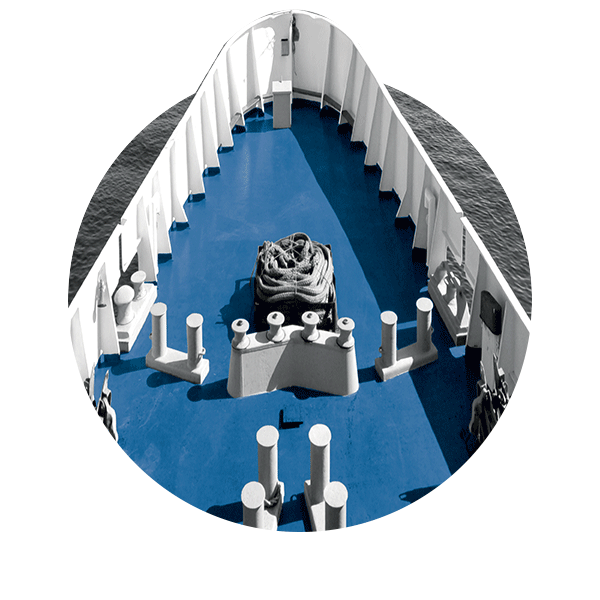

Legal coverage for all aspects of the marine business.

The marine business requires the support of a number of different operations to keep things moving. Our experienced team understands the risks that these specialized marine businesses face and will design policies to protect an entire operation. Depending on your specific business and individual needs, we can combine the coverages below, as well as other coverages, to ensure that your business is protected.

Coverage Limits

- Up to $5,000,000 for primary marine liabilities

- Up to $50,000,000 for any one hull

Coverages (including but not limited to):

Ship Repairer’s Legal Liability

Liability coverage for a contractor repairing a vessel in a shipyard, at a dock or on the water. This coverage includes legal protection in the event of damage to vessels, equipment and property while being repaired and in transit.

Wharfinger’s Legal Liability

Protection for wharf and dock owners for damage to vessels, cargo and other property docked at their facilities. This coverage includes protection for wreck removal expenses or downstream damage caused by a breakaway.

Terminal Operator’s Legal Liability

Liability coverage for damage or loss of property under the care, custody and control of the terminal operator. This broadly defined coverage can include material goods being stored by operators of wharves, piers, docks, stevedores, storage tanks and warehouses.

Charterer’s Legal Liability

Provides liability coverage including care, custody and control for companies chartering a vessel for a wide variety of uses. This can cover liabilities such as damage during loading and unloading of cargo or loss of use due to a collision.

Stevedore’s Legal Liability

Protection including coverage for care, custody and control for terminal operators and contractors in the loading and unloading of cargo on marine vessels, trucks, railcars and other conveyances.

Tankerman’s Legal Liability

Legal protection for tankerman operations involving the loading and unloading of cargo transported by tanker vessels. This cargo requires experienced insurers that understand the higher risks of damage, pollution and injury this cargo presents and know how to protect against them.